What are ESG Scores and How are they calculated

What is an ESG Score?

An ESG score is a quantitative measurement of a company’s performance in environmental, social, and governance areas. The score provides a comprehensive view of the company’s overall ESG performance and helps stakeholders make informed decisions about investments, purchases, and operations.

Why are ESG Scores Important?

ESG scores are important because they provide a holistic view of a company’s performance in areas that are becoming increasingly important to investors, consumers, and businesses alike. In today’s world, consumers and investors are increasingly focused on making responsible and sustainable choices, and ESG scores can help them make informed decisions. ESG scores are also becoming increasingly important to businesses, as they provide valuable insights into areas that need improvement, and help companies identify opportunities for growth and innovation.

How are ESG Scores Calculated?

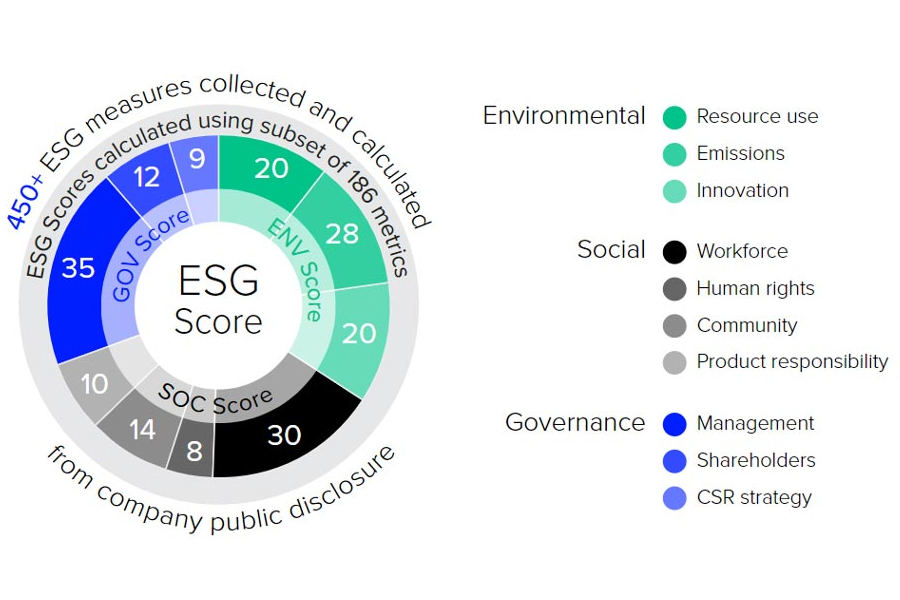

ESG scores are calculated using a combination of publicly available data and expert assessments. The data used to calculate ESG scores is sourced from a variety of sources, including company reports, news articles, and data from industry groups and non-profit organizations. The expert assessments are provided by ESG rating agencies, which use proprietary methodologies to assess the ESG performance of companies. The calculation of ESG scores typically involves three main steps: data collection, data analysis, and score calculation. In the data collection step, relevant data is sourced from a variety of sources and collected into a database. In the data analysis step, the data is analysed to determine the ESG performance of the company. Finally, in the score calculation step, the ESG performance is converted into a score using a proprietary methodology.

ESG Score Components

ESG scores typically consist of three main components: environmental, social, and governance. Each component is weighted differently, depending on the methodology used by the ESG rating agency. The environmental component assesses the company’s performance in areas such as sustainability, carbon emissions, and environmental impact. The social component assesses the company’s performance in areas such as employee relations, community engagement, and human rights. The governance component assesses the company’s performance in areas such as corporate governance, ethical behaviour, and transparency.

In conclusion

ESG scores provide a comprehensive view of a company’s performance in environmental, social, and governance areas, and are becoming increasingly important for investors, consumers, and businesses alike. Understanding what ESG scores are and how they are calculated is crucial for making informed decisions about investments, purchases, and operations.